A kid in one of my classes took out an $11,000 loan to pay for $7,000 in expenses. It was given at a

no starting interest, causing him to think of it as free money. Because he thought it was free money, he ended up spending an extra $4,000 that he didn't have on stuff he didn't need. One possible solution to this would be education. If this kid had taken a class in highschool he might have realized the problems this would cause down the road. Another solution would be one that IU schools utilize. Before you receive any aid from an IU school or the government you must complete a two hour course. This course covers everything from loans, to personal budgeting.

The second problem is how easily you can get money. This causes two things to occur. The first, college prices increase, because their is more money to be had. The second, kids borrow more than they can afford. This is what causes people to be $100,000+ in student loan debt. The solution to this problem is not simple. The best way to fix this problem would be to completely get rid of government funding. This is by far the easiest way to get student loans. However, this type of solution would cause lots of problems in the short term. It would take awhile for the markets to adjust. We would see prices to attend college come down significantly.

Another way to lower the prices of college would be to lower the demand. Right now in the United

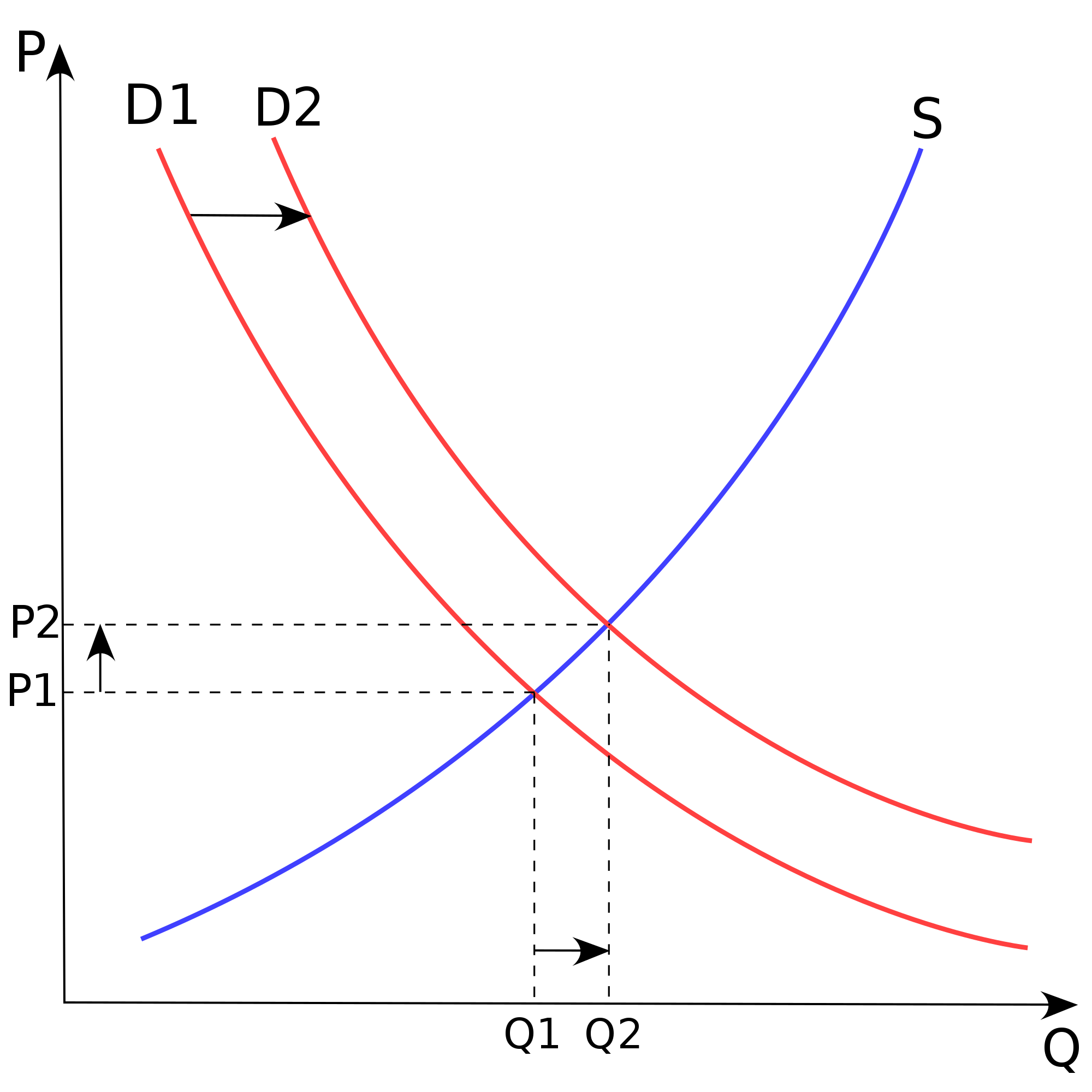

Another way to lower the prices of college would be to lower the demand. Right now in the United States basically everyone thinks that you need a college education to get anywhere in life. This just simply isn't true. There are many trade schools that people could attend. This would be cheaper for them, and lower the demand for college. Lowering the demand would lower the price according to the supply and demand curve.

There are no immediate solutions to this debt that is destroying secondary education. There are steps that could be taken. There is no doubt a need to start making changes. At this rate a college education might not even be feasible in 10 to 20 years.

Seth

Twitter: @seth_pickel

IG: @seth_pickel

Snapchat: @seth_pickel

No comments:

Post a Comment